Unlock the Power of Credit Cards for Seamless Payments in Real Estate Investing

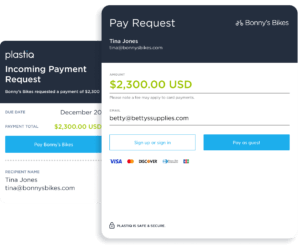

As a financial advisor, I understand the importance of managing payments efficiently for real estate investors. That’s why I want to introduce you to Plastiq, a game-changing payment processor that enables you to pay contractors, vendors, and suppliers with credit cards, even if they don’t typically accept card payments. With Plastiq, you can streamline transactions, optimize cash flow, and take advantage of credit card benefits, such as earning valuable rewards.

Here are the key benefits of using Plastiq in real estate:

Time Management: Say goodbye to time-consuming tasks like writing checks or meeting contractors in person. With Plastiq, you can conveniently pay your recipients through methods like checks, ACH transfers, or wire transfers. No more rushing through traffic or wasting precious time. Simply obtain the necessary bank information and send a wire transfer for same-day payment, ensuring both parties are satisfied.

Cash Flow Optimization: Real estate investors often juggle multiple projects with significant expenses. Plastiq allows you to leverage credit cards when cash in the bank is tight. Enjoy the grace period typically provided by credit card companies, giving you 15-30 days after the statement date to pay without incurring interest. This flexibility empowers you to manage your finances effectively, even during periods of tight liquidity.

Flexible Payment Options: Plastiq offers a range of payment types and delivery methods to suit your preferences. Sending snail mail checks directly from your business bank account is free, while same-day wire transfers come with a 2.9% credit card fee plus a $5.00 wire transfer fee. You’ll find several other payment options available, ensuring a tailored solution for every payment scenario.

Automated Payments: Take advantage of Plastiq’s scheduled or recurring payment feature. This automation streamlines your payment processes, enabling you to better manage future funds, ensure timely payments, and eliminate increased credit card processing fees charged by vendors. By simplifying your payment workflow, you can focus on what matters most: growing your real estate portfolio.

Credit Card Rewards and Benefits: Plastiq allows you to maximize your credit card rewards programs. Earn cashback, airline miles, or other enticing rewards offered by your credit card provider. These rewards can significantly add up, especially when making substantial payments for labor and supplies. The value of credit card rewards combined with the extra time to pay off your expenses makes the 2.9% Plastiq transaction fee well worth it.

Ready to start using Plastiq for your real estate payments?

Here’s how:

Sign Up and Create a Free Account: Visit the Plastiq website or download the mobile app to create your account. Provide the necessary information, including your business details and payment preferences.

Verify Your Account: Plastiq may require additional information to verify your account. This may involve submitting identification documents or providing business-related documentation. Rest assured that this step ensures the security and integrity of your transactions.

Add Payment Recipients: Once your account is set up, add your contractors, vendors, and suppliers as payment recipients. Provide their contact details and preferred payment methods. Additionally, don’t forget to refer your vendors and contractors to earn “Fee-Free Dollars,” allowing you to avoid the 2.9% Plastiq fee for $2500 worth of payments per referral.

Chase Ultimate Rewards Real Example The Chase Ink Preferred card offers 3x points on some categories like advertising and shipping. So, as an business owner, just pay with this card and you completely offset any credit card processing fees with the points earned. If you prefer strait cash redemption or don’t want to track category spend, the Chase Ink Premiere card offers 2% cashback on every purchase and 2.5% on transactions over $5,000. Either way, it allows business owners to grow on their schedule! Click here to sign up for Plastiq and to support more posts like this!